The debate over whether the wealthy pay their fair share of taxes continues to be a contentious issue in the United States. Politicians such as Joe Biden, Kamala Harris, Sen. Martin Heinrich, and Rep. Melanie Stansbury have often stated that the rich do not contribute enough in taxes compared to low- and moderate-income taxpayers.

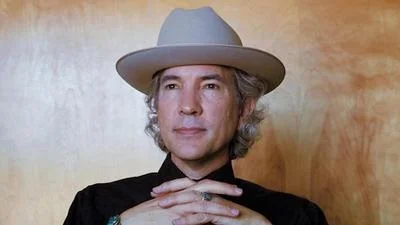

Paul Gessing, president of New Mexico’s Rio Grande Foundation, challenges this assertion by pointing to data from the Joint Committee on Taxation. According to Gessing, "the chart shows that at the federal level, combined employment income and excise taxes consume 2.2% of the earnings of those making $15,000 annually or less." He further notes that "those earning between $80,000 and $100,000 pay 14.7%, while those earning more than $1 million pay an average tax rate of 30.4%."

Gessing argues that these figures demonstrate how higher-income individuals already bear a larger tax burden due to the progressive nature of the U.S. tax code. He criticizes media outlets for not challenging claims like President Biden's statement that “a schoolteacher in West Virginia paid higher taxes than Elon Musk.”

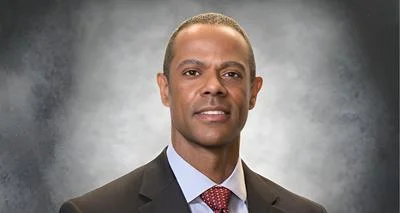

In response to concerns about wealthy individuals paying insufficient taxes, President Biden has proposed taxing "unrealized" earnings—a plan endorsed by Vice President Kamala Harris. This proposal would target assets such as stock shares or real estate whose value has increased but have not been sold.

Gessing questions this approach by asking how individuals would fund these taxes without selling their assets and why they should be taxed on gains attributed to inflation driven by government policies.

He acknowledges the nation's fiscal imbalance is severe with a federal debt reaching $36 trillion but attributes it primarily to rising federal spending rather than inadequate taxation.

Regardless of political leadership, Gessing emphasizes fiscal restraint as essential for addressing financial issues without resorting to what he views as unfair taxation on unrealized capital gains.