Hobbs officials are calling for a change to a state law they claim caused an unintentional loss of gross receipts tax revenue for the community, Albuquerque CBS affiliate KRQE reported.

In 2019, New Mexico lawmakers passed, and Gov. Michelle Lujan Grisham signed, legislation that helps companies by requiring them to pay a gross receipt tax based on where the services are provided rather than where the company is located, according to the station.

Hobbs City Commissioner Dwayne Penick said that the destination tax could cost his city to bleed $20,000 to $25,000 a month.

“The oilfield companies that work outside of the city limits of Hobbs, out in the county, or whatever, the state gets the majority of that tax base,” Penick told the Hobbs News-Sun reported.

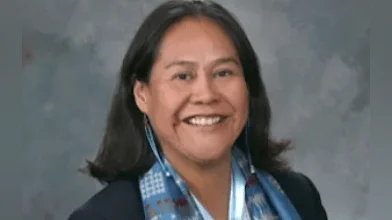

Sam Cobb, the city’s mayor, said the state legislature except for Rep. Larry Scott (R-Hobbs) passed the bill to recoup gross receipts taxes from online businesses, adding the legislation would require out-of-state companies to pay a higher tax, KRQE reported.

“The intent of the legislation was to be sure that the Amazons of the world were remitting taxes to the local communities in which they were delivering goods,” Cobb told the station. “They didn’t realize that a community like ours, that is so service driven, it had a negative impact.”

The city has hired lobbyists to urge for an amendment during the legislative session. According to KRQE, municipal revenue suffered since many communities have service-driven economies while the state revenue increased.

The station added that the bill in its original form had an income tax hike and taxes on vehicles, but lawmakers stripped those out.