In October last year, Truth in Accounting published its annual Financial State of the States, study. New Mexico was given a financial grade of “D.” The report stated: “New Mexico’s financial problems stem mostly from unfunded retirement obligations.” “…New Mexico had only set aside 75 cents of every dollar of promised pension benefits and 23 cents for every dollar of promised retiree health benefits. If benefits and funding are not changed future taxpayers will be burdened with paying the under-funded retirement promises.”

The two largest public sector pension plans in New Mexico are the Public Employees Retirement Association (PERA) and the Education Retirement Board (ERB). The PERA has five distinct retirement plans for these divisions: state general; state police/corrections; municipal general; municipal police and municipal fire. The ERB generally covers all full- time employees of a New Mexico public education institution.

Most workers in the private sector who have retirement plans, have defined contribution or profit-sharing plans. In a typical defined contribution plan, the employer and the employee contribute to the employee’s retirement account with pre-tax income. The retirement account is managed by the employee who can make his own permitted investment decisions. When the employment terminates, the retirement account belongs to the employee. The employee has no guaranteed amount he will receive in retirement.

In contrast, in a defined benefit plan, the worker will usually receive a known monthly payment, based on a formula that typically uses the number of years of employment and average salary received to determine the payment amount. Most public sector workers in the United States have defined benefit retirement plans.

Defined benefit retirement plans are much more expensive to fund and administer than defined contribution plans. With a defined benefit plan, the employer’s contractual obligations to the former employee can last for decades after the employee’s termination or retirement. A large factor in the bankruptcies of General Motors, Chrysler and the City of Detroit was the inability to afford defined benefit pension plan payments. Here in New Mexico, even companies as financially strong as Sandia Labs have ended their defined benefit retirement plans. The costs are simply too great.

Each year on June 30, the ERB and PERA publish an annual actuarial valuation report, available on the internet, describing the financial condition of the respective funds. Here are some pertinent facts from the 2022 reports.

1 Of the five PERA retirement plans, only the state police/corrections plan is overfunded at 123.8%. The other four plans are all have unfunded actuarial accrued liability (UAAL). Their funded ratios are from 56% to 74%.

2 The largest PERA fund is the state general fund. As of 6/30/22 its funded percentage was only 58.8%. Its unfunded liability was $4,158,051,820. When that figure is divided by the membership total of 49,940, the amount comes to $83,260 per member.

3 The net total of the unfunded liability for the five PERA funds is $ 7,615,240,886.

4 As of 6/30/22, the funded ratio of the ERB pension plan was only 63.5%, and the UAAL was $8,841,049,868. When that number is divided by the membership total of 167,132, the result is $52,898 per member.

In addition to PERA and ERB pension liabilities, since 1990 New Mexico has provided healthcare benefits for retirees who receive PERA or ERA pensions. The benefit is administered by the New Mexico Retiree Healthcare Authority (NMRHCA). As of 6/30/22, the program only had a funded ratio of 33.3% and an unfunded liability of $2,311,603,052. When that number is divided by the membership total of 157,131, the per member amount is $14,711.

As the famous conservative economist Herb Stein (father of Ben Stein) once quipped, “If it can’t go on forever, it will stop.” That describes New Mexico’s tremendously generous public sector pension plans. The total unfunded liability of the three described plans is an astonishing $18,767,893,052 (BILLIONS) as of 6/30/22. When I divide that figure by the total New Mexico population of 2.1 million, I get a number of $8939 per person just to erase the unfunded liability – an impossible task.

The proper question to ask about New Mexico public sector pension plans is not if but when they will begin to collapse financially. When that happens, expect political upheaval.

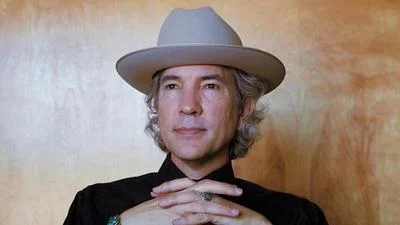

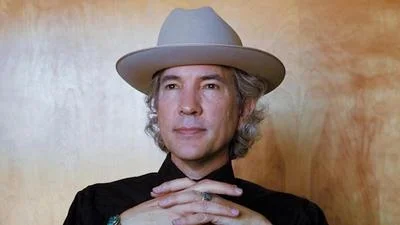

Charles Sullivan is a retired attorney who has lived in NM for over 40 years.